Pick a date to view the schedule, then scroll down to see what's in store. Click on any session card to learn more or find out where it's happening.

Sunday

10

Monday

11

Tuesday

12

9 am

10 am

11 am

12 pm

1 pm

2 pm

3 pm

4 pm

5 pm

6 pm

7 pm

8 pm

9 pm

10 pm

11 pm

12 am

Golf Tournament

9:00AM Shotgun Start

10:00AM - 5:00PM

Registration Desk

10:00AM - 3:45PM

Lunch

11:30AM - 1:30PM

Cyber Risk

12:00PM - 1:00PM

Break 15 minutes

Today's MGAs

1:15PM - 2:15PM

Break 15 minutes

Captive & Parametric Insurance

2:30PM - 3:30PM

Break 15 minutes

Hard Market Leadership

3:45PM - 4:45PM

100 Years in the Making

Champagne Service: 5:00PM - 6:00PM

Gallery will remain open

Hospitality Night

5:30PM - 8:00PM

Peace Hills Party

8:00PM - Midnight

7 am

8 am

9 am

10 am

11 am

12 pm

1 pm

2 pm

3 pm

4 pm

5 pm

6 pm

7 pm

8 pm

9 pm

10 pm

11 pm

12 am

Breakfast

7:30AM - 9:00AM

Registration Desk

8:00AM - 1:00PM

Alberta Care First Panel

8:30AM - 9:30AM

Break 15 minutes

Keynote Seth Mattison - Future-Ready

9:45AM - 10:45AM

Break 15 minutes

Carrier CEO Panel

11:00AM - 12:00PM

Lunch & CaptiveSimple Demo

12:00PM - 1:00PM

Navigating Broker Risk Management

1:00PM - 2:00PM

Break 4 hours

Champagne & Crystals Reception

6:00PM - 7:00PM

President's Gala

7:00PM - 10:00PM

Wawanesa After Party

10:00PM - Midnight

7 am

8 am

9 am

10 am

11 am

12 pm

1 pm

2 pm

3 pm

4 pm

5 pm

6 pm

7 pm

8 pm

9 pm

10 pm

11 pm

12 am

Breakfast

7:00AM - 9:30PM

Registration Desk

8:00AM - 2:30PM

Industry Challenges Panel

8:30AM - 9:30AM

Break 15 minutes

The Broker’s Guide to AI

9:45AM - 10:45AM

Break 15 minutes

Financial Business Trends for Brokerages

11:00AM - 12:00PM

Lunch & Emerging Software Demo

12:00PM - 1:00PM

Broker Town Hall

1:00PM - 2:30PM

Trade Show

2:30PM - 6:30PM

SGI CANADA After Party

8:00PM - Midnight

Golf Tournament

May 10th | 9:00AM - 5:00PM

Location: Banff Springs Golf Course

Join fellow brokers and industry leaders for a picturesque 18-hole (team scramble format) round of golf at the 28th Annual IBAA Golf Tournament. Register to enjoy the good food, better connections, and incredible views. Rain or shine, golfers of all skill levels and abilities are welcome. Registration opens at 9:00 a.m. with a 10:00 a.m. shotgun start. If you are looking to register for the tournament, either use the registration options at the top of the page or click the button below.

Registration Desk

May 10th | 10:00AM - 4:45PM

Location: Van Horne Foyer

Start your convention experience right and check in at our registration desk. Come get your badge, your delegate giveaway, and any other goodies set aside for you. If you have any questions about the convention, need help navigating, or you just want to come meet the staff, we'll be set up each day throughout the events.

Lunch

May 10th | 11:00AM - 1:30PM

Location: President's Hall Foyer

Once you've checked in at our registration desk, join us for a buffet-style lunch provided by the Fairmont.

If you are out golfing, lunch will be supplied on the course.

Cyber Risk

May 10th | 12:00PM - 1:00PM

Location: Van Horne Ballroom

More details coming soon!

Today's MGAs

May 10th | 1:15PM - 2:15PM

Location: Van Horne Ballroom

This session provides brokers with a deeper understanding of the MGA model, strategies for building stronger partnerships, and tips to stay ahead of emerging trends that are shaping Canada’s insurance market.

Description & Objectives

This seminar provides a comprehensive overview of the Managing General Agent (MGA) model and its role within the Canadian insurance ecosystem. It then explores the value MGAs bring to brokers and dispels common myths. Participants learn practical ways brokers can strengthen and maximize their relationships with MGAs, followed by a discussion of the MGA value proposition from the insurer’s perspective. The seminar also addresses key challenges and considerations in the MGA space. The session concludes with a look toward the future of MGAs in Canada. The seminar wraps up with an open Q&A discussion.

- Understand the MGA model and its place in the Canadian insurance landscape, including the role of CAMGA and how MGAs operate.

- Identify the unique value MGAs provide to brokers and insurers, and learn practical strategies to build and maximize effective MGA–broker relationships.

- Evaluate current challenges and emerging trends shaping the future of MGAs in Canada, enabling participants to anticipate shifts and opportunities in the market.

Brett Boadway

Executive Director

CAMGA

Captive & Parametric Insurance: What Brokers Need to Know

May 10th | 2:30PM - 3:30PM

Location: Van Horne Ballroom

This session will help brokers better understand the fundamentals of captive insurance, identify ideal candidates, and learn how these solutions can enhance advisory capabilities, client retention, and long-term strategic value in a changing market.

Description & Objectives

Captive insurance is rapidly becoming an essential tool for brokers who want to expand their advisory capabilities, strengthen client retention, and offer innovative risk solutions in a changing marketplace. This session provides a clear, practical introduction to the fundamentals of captive insurance, including when it makes sense, who it works best for, and how brokers can begin integrating captive conversations into their business model.

Attendees will learn how to identify strong captive candidates, understand the key indicators of viability, and recognize the long-term strategic advantages captives offer to both clients and brokerages. The discussion will also explore the broader economic impact of captives in Canada, including how shifting even a modest percentage of commercial premiums into captive structures can redirect capital back into businesses and local communities.

While the primary focus of this session is captive insurance, participants will also receive a high-level overview of parametric insurance—what it is, how it differs from traditional coverage, and when it may serve as a complementary or alternative solution in specific scenarios. The intent is not to provide an in-depth analysis of parametric products, but to give brokers enough context to recognize when these tools may merit further exploration.

- Understand the core principles of captive insurance and where it fits in modern risk management.

- Recognize ideal client profiles and the key indicators that suggest a captive may be viable.

- Explain the strategic advantages captives offer for client retention, advisory value, and long-term financial stability.

- Assess the economic impact of shifting traditional premiums into captives for businesses and local communities.

- Initiate confident conversations with clients about when and why to explore captives.

- Incorporate captives into a brokerage model in a practical, scalable way.

- Gain a basic awareness of parametric insurance and when it may complement a captive or traditional program.

Whitney Benson

Founder, COO/CTO

CaptiveSimple

Hard-Market Leadership: Results Without Burnout

May 10th | 3:45PM - 4:45PM

Location: Van Horne Ballroom

This session gives brokers actionable strategies and leadership practices to boost productivity, prevent burnout, and build resilient, high-performing teams in any market environment.

Description & Objectives:

In today’s hard market, leaders are under pressure to drive higher performance with tighter margins, leaner teams, and rising client expectations. Too often, the cost is invisible but massive: burnout, rework, mistakes, and avoidable turnover that quietly erode profitability and team trust. This session is designed for executives and senior leaders who want to protect both performance and people. We’ll unpack what burnout is truly costing your organization in throughput, error rates, and lost capacity—and how to reclaim that value without pushing your team harder.

- Productivity levers that reduce burnout: Practical ways to simplify workflows, prioritize work, and remove friction so high performance feels sustainable, not punishing.

- AI as a safe capacity multiplier: Where AI tools can responsibly streamline low-value tasks, support decision-making, and free humans up for higher-impact work—without compromising compliance or client trust.

- Leader behaviours that scale: Everyday leadership practices that build clarity, confidence, and psychological safety, even in high-pressure environments.

- Culture + process alignment: How to align expectations, incentives, and processes so your “way of working” supports wellbeing and results, instead of forcing people to choose between the two.

Rikka Bouseh

President, CPHR

Envol Solutions Inc.

100 Years in the Making: Sip, See & Stroll

May 10th | 5:00PM - Ongoing

Location: Mt. Stephen's Hall

From 1926 to today, explore our fascinating history of the IBAA at your own pace in this curated gallery experience.

More details are coming soon.

Hospitality Night

May 10th | 5:30PM - 8:00PM

Location: Alberta Room

The perfect way to kick off a remarkable evening!

Hospitality Night details are coming soon. Stay tuned!

Peace Hills Party

May 10th | 8:00PM - Midnight

Location: Cascade Ballroom

Sponsored By:

Get ready for a night of incredible fun, music, and surprises!

Peace Hills Party details are coming soon. Stay tuned!

Breakfast

May 11th | 7:30AM - 9:00AM

Location: Van Horne Foyer

Start your day right with an early buffet-style breakfast in the Van Horne Foyer. The day's sessions will all be nearby.

Registration Desk

May 11th | 8:00AM - 1:00PM

Location: Van Horne Foyer

Start your convention experience right and check in at our registration desk. Come get your badge, your delegate giveaway, and any other goodies set aside for you. If you have any questions about the convention, need help navigating, or you just want to come meet the staff, we'll be set up each day throughout the events.

Alberta Care First Panel

May 11th | 8:30AM - 9:30AM

Location: Van Horne Ballroom

A candid discussion of Alberta's auto reform that includes government representatives and industry stakeholders. More details of this session to come.

Future Ready: Leading Growth, Trust, and Client Value in an Age of Disruption

May 11th | 9:45AM - 10:45AM

Location: Van Horne Ballroom

This session provides the mindsets and tools to thrive amid uncertainty, strengthen client loyalty, and lead with impact in a world where human connection is the ultimate advantage.

Description & Objectives

The insurance industry is evolving rapidly, demanding brokerages to grow, advise, and execute amid rising complexity and technological change. Led by Seth Mattison, Founder and CEO of FutureSight Labs, Future-Ready Brokerage equips brokers to lead with confidence, elevate advisory value, and strengthen client trust in uncertain times. Drawing on decades of research into leadership and performance, this session introduces four critical mindsets—agency, alignment, expansion, and activation—to help brokers shift from reactive work to strategic partnership. Learn practical tools to turn complexity into client value, leverage AI without losing the human edge, and build trust through clear communication. Participants will leave with actionable frameworks to grow their business, activate teams, and deliver exceptional results in a fast-changing risk landscape.

- Understand the core Future-Ready competencies required of today’s high-performing brokers.

- Explore how to balance technology, AI, and human connection to elevate client value.

- Identify strategies to unlock capacity and reduce burnout through regenerative work practices.

- Build skills to communicate with clarity, influence outcomes, and strengthen client trust.

- Discover tools to activate teams around growth, execution, and aligned action.

- Gain practical tactics for leading clients through uncertainty and change.

Seth Mattison

Co-Founder & CEO

FutureSight Labs

Carrier CEO Panel

May 11th | 11:00AM - 12:00PM

Location: Van Horne Ballroom

Join top insurer executives as they discuss the state of the industry and how companies are evolving to keep pace with the changes. More details to come.

Nav Dhillon

CEO

Aviva

Louis Gagnon

CEO

Intact

Evan Johnston

President & CEO

Wawanesa

Pete Tessier

President

Taycon Risk & CAMGA

Lunch & CaptiveSimple - A Live Demo & How Brokers Can Leverage It

May 11th | 12:00PM - 1:00PM

Location: Riverview Lounge

This demo will showcase how CaptiveSimple streamlines captive feasibility studies by cutting costs, reducing timelines, and providing a user-friendly platform that empowers them to confidently explore captive solutions for clients.

Lunch will be served during the demo.

Description & Objectives:

This live demo will walk brokers through CaptiveSimple, an InsurTech platform designed to simplify and modernize the early stages of captive exploration. Created specifically with brokers in mind, CaptiveSimple offers an accessible, user-friendly way to evaluate whether a captive structure may be viable for a client—without the spreadsheets, manual workflows, or uncertainty that have traditionally made captives difficult to approach.

One of the most significant impacts of CaptiveSimple is its ability to dramatically reduce both the cost and time associated with determining captive feasibility. The industry norm for a feasibility study can reach $75,000 and stretch up to 22 months. CaptiveSimple streamlines this process, reducing feasibility costs to $22,500 and compressing the timeline to 30–60 days, depending on the user’s access to required data and actuarial reporting. This shift not only makes captives more accessible to a wider range of clients, but also empowers brokers to begin these conversations with confidence and clarity.

Attendees will see how the platform supports brokerages of all sizes through real-time education, data-driven feasibility indicators, guided next steps, and a clear, standardized workflow that demystifies captive conversations. The demo will highlight key features such as data collection tools, staged reporting, claims integration, intuitive dashboards, and the platform’s unique ability to streamline collaboration among brokers, clients, and actuaries.

Whitney Benson

Founder, COO/CTO

CaptiveSimple

Navigating Broker Risk Management: Practical Lessons from an E&O Case Study

May 11th | 1:00PM - 2:00PM

Location: Alberta/New Brunswick Room

This session will provide brokers with everything they need to know about claim trends, as well as practical tips to help manage loss control to reduce liability.

Description & Objectives:

Modern day brokers and their teams often work under stressful conditions, serving price-conscious clients with varying needs and dealing with underwriters with different risk appetites and ever-changing policy wordings. Through the lens of a broker Errors and Omissions (E&O) case study, this session will highlight claim trends, identify E&O exposures that brokers face when providing professional services, and provide practical tips on how to control their risks to avoid lawsuits or minimize liability.

- Understanding claim trends

- Identify common red flags for errors and omissions

- Learn tips on how to control risks

Grace Leung

Claims Expert, Vice President

Swiss Re Corporate Solutions

Champagne & Crystals Reception

May 11th | 6:00PM - 7:00PM

Location: Van Horne Ballroom

Dress Code: All-Black

Women:

- Black evening gowns, cocktail dresses, or chic jumpsuits

- Fabrics like satin, velvet, sequins, lace, or crepe are encouraged

- Black heels or dressy flats

- Metallic or jewel-toned accessories welcome for contrast

Men:

- Black suit or tuxedo with a black dress shirt or white dress shirt

- Black tie, bow tie, or open-collar dress shirt

- Black dress shoes required

Wear your best black tie attire and get ready to start your evening off with a bang! Mix and mingle at this cocktail hour before the President’s Gala.

More details are coming soon.

President's Gala

May 11th | 7:00PM - 10:00PM

Location: Van Horne Ballroom

Dress Code: All-Black

Women:

- Black evening gowns, cocktail dresses, or chic jumpsuits

- Fabrics like satin, velvet, sequins, lace, or crepe are encouraged

- Black heels or dressy flats

- Metallic or jewel-toned accessories welcome for contrast

Men:

- Black suit or tuxedo with a black dress shirt or white dress shirt

- Black tie, bow tie, or open-collar dress shirt

- Black dress shoes required

Enjoy delicious food, fantastic music, and celebrate the recipients of the IBAA Awards for Excellence on this unforgettable night.

More details are coming soon.

Wawanesa After Party

May 11th | 10:00PM - Midnight

Location: Van Horne Ballroom

Sponsored By:

It’s time to let loose and have the time of your life at this extravagant themed party!

Wawanesa Party details are coming soon. Stay tuned!

Breakfast

May 12th | 7:00AM - 9:30PM

Location: Riverview Lounge

Join us for a delicious breakfast before the events of our final day kick off.

Registration Desk

May 12th | 9:00AM - 1:30PM

Location: Van Horne Foyer

Before you do anything make sure you swing by our registration desk to check in for the event. Come get your badge, your delegate bag, and any other goodies set aside for you. If you have any questions about the convention, need help navigating, or you just want to come meet the staff we'll be setup each day throughout the events.

Industry Challenges Panel

May 12th | 8:30AM - 9:30AM

Location: Alberta/New Brunswick Room

More details coming soon!

The Broker’s Guide to AI, Automation & LLMs

May 12th | 9:45AM - 10:45AM

Location: Alberta/New Brunswick Room

This session gives brokers a clear, practical introduction to AI—without the hype. We break down key concepts like automation, machine learning, and LLMs using simple definitions and real brokerage examples. Participants will see how AI maps directly to everyday workflows, including renewals, client service, data entry, and claims intake. We also cover the risks and limitations of using AI in a brokerage, helping brokers understand where these tools add value and where human oversight is essential. The session includes a straightforward framework for evaluating the ROI of AI deployments—such as time saved, increased capacity, and new revenue opportunities. We finish with guidance on assessing AI vendors, including what to look for in security and data practices, how models are trained, and the pros and cons of point solutions versus multi-function platforms. Brokers will leave with a grounded understanding of AI and a simple method for evaluating tools and vendors with confidence.

Objectives:

- Gain a clear, jargon-free understanding of AI, including automation, machine learning, and LLMs, and how they apply to your brokerage.

- Identify practical AI use cases across renewals, client service, data entry, claims intake, and other core workflows.

- Learn key risks and limitations to ensure safe adoption.

- Evaluate ROI effectively using simple metrics.

- Assess AI vendors confidently with the right questions.

Thomas Berry

Director of Insurance & AI Transformation

Solera

Financial Business Trends for Brokerages

May 12th | 11:00AM - 12:00PM

Location: Alberta/New Brunswick Room

This session will provide attendees with an understanding of how industry trends may impact their future financial performance.

Description & Objectives

Understanding where your brokerage stands, and where the industry is headed, is essential for long-term success. This course provides a comprehensive review of historical financial benchmarks for the brokerage sector, offering participants a clear picture of how their performance compares to industry standards. The session explores current and emerging trends that could reshape these benchmarks in the years ahead. By examining these factors, you’ll learn how to anticipate potential impacts on your own business and identify opportunities for growth.

Alex Wong

Partner, CPA, CA, CBV

Smythe

Lunch & Emerging Software Demo - Trufla

May 12th | 12:00PM - 1:00PM

Location: Riverview Lounge

Take a break and recharge with lunch in the main building at the Riverview Lounge.

Trufla Technologies will provide a demo of some of their software while you eat. More info to come soon!

Broker Town Hall

May 12th | 1:00PM - 2:30PM

Location: Alberta/New Brunswick Room

Details of this event are coming soon. Stay tuned!

Trade Show

May 12th | 2:30PM - 6:30PM

Location: Van Horne Ballroom

Create lasting connections with brokers and industry partners at the IBAA Convention Trade Show. From across Alberta, we invite brokers and vendors to join us on May 12th to connect with one another to build opportunities and a stronger community.

Access to the trade show is part of participant registration for those who are attending on May 12th. If you are a vendor looking to register a booth, either use the registration options at the top of the page or click the button below.

The IBAA Convention 2026 trade show will be an evening trade show, running from 2:30pm - 6:30pm and will take place in the Van Horne Ballroom. To see a full map of the space, please click here.

SGI CANADA After Party

May 12th | 8:00PM - Midnight

Location: Cascade Ballroom

Sponsored By:

Don’t miss the incredible convention finale! Enjoy a cocktail, dance your shoes off, and close out our 100th anniversary with a bang!

More details to come soon.

Brett Boadway

Executive Director

CAMGA

Brett Boadway is the Executive Director of the Canadian Association of Managing General Agents (CAMGA), bringing a rare blend of trade association leadership and deep insurance industry experience to the role. She began her career at The Dominion of Canada General Insurance Company before advancing to the Insurance Brokers Association of Ontario (IBAO), where she ultimately served as Chief Operating Officer. Brett holds a business degree with a specialization in finance from Western University, complemented by post-graduate studies in law, finance, e-commerce, public relations, and a Mini MBA from the Schulich School of Business. She is passionate about inspiring the next generation of insurance professionals, fostering collaboration, and building meaningful bridges across the industry. Brett lives in Toronto with her husband and twin daughters.

Presenting:

Today's MGAs

Sunday, May 10th | 1:15PM - 2:15PM

Whitney Benson

Founder, COO/CTO | CaptiveSimple

Community Engagement Leader | Paramount Insurance

Whitney Benson is a 20-year insurance veteran whose expertise spans brokerage, carrier roles, and tech innovation, making her the ideal guide to demystify captive insurance. As co-founder of CaptiveSimple, launched May 1, 2025, she’s revolutionized captives by automating processes, cutting setup costs by 50%, and empowering brokers and clients with accessible tools and education. Her leadership at Paramount Insurance, a family-owned brokerage, earned the 2025 Best Small Brokerage award, preserving its independence in a consolidating industry. Known for her humor, empathy, and practical insights, Whitney blends real-world experience with a passion for community—evidenced by her #30years30charities initiative supporting 30 Central Alberta charities. As a working mom, she champions work-life balance, mentoring teams and students to grow with purpose. Whitney’s engaging style and transformative vision make captives approachable, inspiring attendees to unlock new opportunities for their clients.

Presenting:

Captive & Parametric Insurance

Sunday, May 10th | 2:30PM - 3:30PM

Lunch & CaptiveSimple Demo

Monday, May 11th | 12:00PM - 1:00PM

Rikka Bouseh

President, CPHR

Envol Solutions Inc.

Rikka is a seasoned HR strategist with 16+ years of experience helping organizations turn people challenges into business advantages. With a unique ability to bridge talent strategy with operational outcomes, she has supported companies across North America — from high-growth startups to complex, multi-national enterprises — in improving performance, navigating change, and accelerating growth through smarter people practices.

Known for her sharp business acumen and collaborative leadership style, Rikka partners closely with executive teams to design HR strategies that fuel organizational goals. Whether scaling operations, strengthening leadership pipelines, or guiding organizations through major transformation, her work is rooted in practical, real-world application — not theory.

With deep expertise in instructional design, facilitation, organizational development, and change leadership, Rikka brings both structure and simplicity to complex people challenges. She is especially skilled at creating alignment across diverse stakeholder groups, ensuring teams feel heard while driving toward clear, measurable business outcomes.

Today, Rikka empowers organizations and HR teams to think more strategically, act more intentionally, and build workplaces where people and performance thrive. Her approach consistently delivers what leaders value most: clarity, alignment, and momentum.

Presenting:

Hard Market Leadership

Sunday, May 10th | 3:45PM - 4:45PM

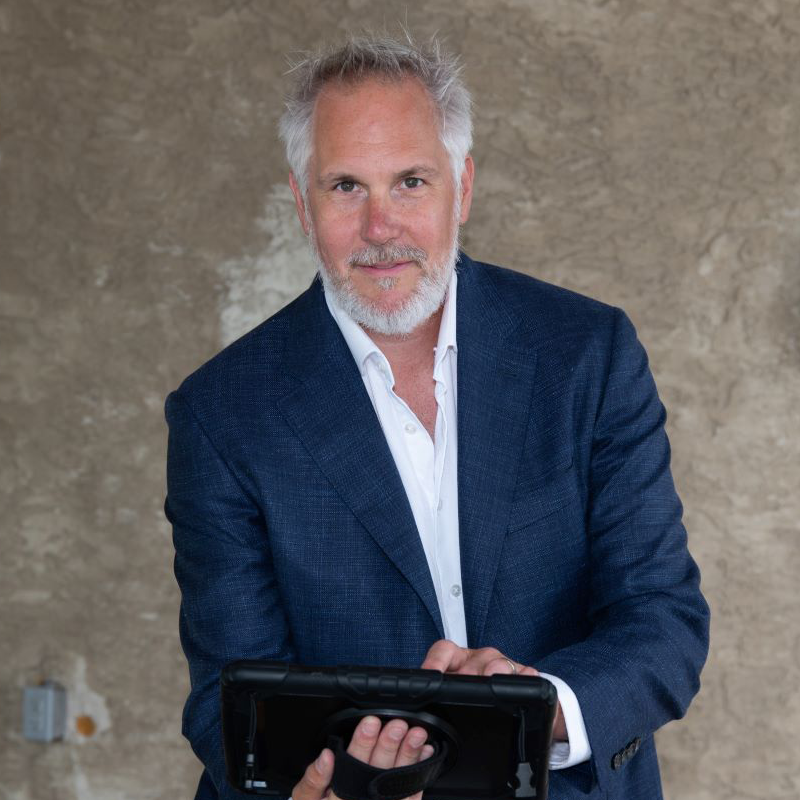

Seth Mattison

Top 50 Keynote Speakers in the World, Future of Work Strategist, Co-Founder & CEO

FutureSight Labs

Seth Mattison is an internationally recognized author, keynote speaker, and leadership strategist who has spent more than two decades studying the future of work, human behavior, and high-performance leadership. As the Founder and CEO of FutureSight Labs, Seth works alongside many of the world’s most recognizable brands—State Farm, C&F, TD SYNNEX, Dell Technologies, TIAA, Daikin, State Farm, and numerous financial and insurance institutions—to help leaders and teams navigate transformation and build future-ready cultures.

Seth is known for bringing a rare blend of warmth, clarity, and strategic insight to every stage. His work sits at the intersection of human performance and organizational transformation, helping leaders unlock capacity, elevate trust, and create environments where people do exceptional work. His signature research explores themes such as regenerative work (how to create work that gives more than it takes), the Human Advantage (how to thrive in an age of AI and acceleration), and future-ready leadership (how to lead growth and execution in moments of complexity).

Raised on a fourth-generation family farm in Minnesota, Seth brings a grounded, human perspective to modern leadership challenges. His stories of stewardship, responsibility, and care—shaped by lessons from the land—resonate deeply with today’s leaders who are being asked to deliver growth while protecting well-being and earning trust in an increasingly complex world.

A sought-after speaker for industry associations, brokerages, and insurance organizations, Seth has been featured by Fast Company, The Wall Street Journal, and Forbes. He is valued for his ability to translate emerging trends into practical tools that help brokers strengthen relationships, activate teams, and lead their clients forward with confidence and conviction.

Presenting:

Future Ready: Leading Growth, Trust, and Client Value in an Age of Disruption

Monday, May 11th | 9:45AM - 10:45AM

Grace Leung

Claims Expert, Vice President

Swiss Re Corporate Solutions

Grace Leung is a Claims Expert & Technical Lead at Swiss Re Corporate Solutions.

Grace completed her undergraduate degree at the University of Toronto in 2001 and received her Juris Doctor degree, cum laude, from the John Marshall Law School, in 2004. Grace has many years of experience as an insurance coverage lawyer and defence litigator in Chicago, Illinois, and Toronto, Ontario, handling Property, CGL, E&O and D&O claims. After leaving private practice in 2019, Grace worked in the Claims department of two other multinational insurance companies.

Grace is currently based in Toronto, working closely with insureds and panel counsel across Canada and the US to defend claims. She is honored to have been invited to speak at many industry events over the years that highlight insurance claim trends and best practices to reduce the risk of claims.

Presenting:

Navigating Broker Risk Management: Practical Lessons from an E&O Case Study

Monday, May 11th | 1:00PM - 2:00PM

We'll wrap things up on Wednesday morning with a cheerful Breakfast from 8:30-10:00am before you head out for the day!

Ready to join us at Convention 2026?

Be party of Alberta's biggest insurance community event. Connect, learn, and celebrate with peers from across the province.